Coindataflow Review 2025 – Is This Crypto Analysis Tool Worth It?

In the fast-evolving world of cryptocurrency, data is everything. Investors need accurate insights, reliable forecasts, and a clear understanding of market trends before making decisions. That’s where Coindataflow comes into play-a comprehensive crypto data analytics platform that provides deep insights into digital currencies, helping users make smarter investment choices.

Coindataflow stands out as a go-to resource for real-time market data, long-term predictions, and historical coin performance. But is it truly worth your time and money? Let’s find out in this Coindataflow Review 2025.

How Coindataflow Works

Coindataflow gathers live data from multiple exchanges worldwide, processing billions of data points every day. It uses sophisticated algorithms that analyze price trends, trading volumes, and blockchain activities. This helps users identify potential growth coins and anticipate market reversals with impressive accuracy.

Real-Time Cryptocurrency Tracking

The platform offers live price tracking for thousands of cryptocurrencies, including Bitcoin, Ethereum, and emerging altcoins. Charts refresh automatically every few seconds, providing investors with the most current data available.

Long-Term Investment Insights

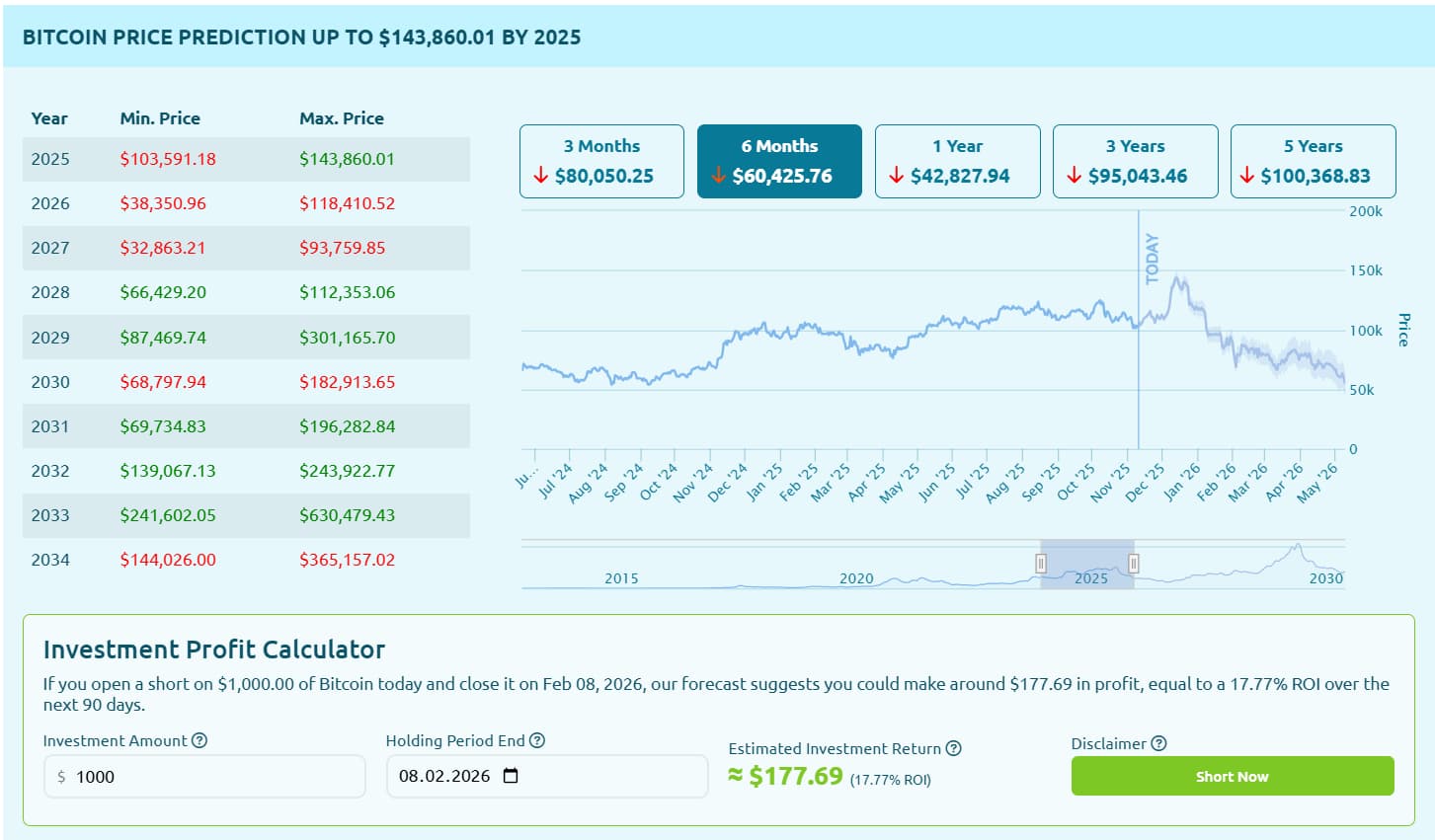

Coindataflow doesn’t just show what’s happening right now-it also predicts what might happen next. Using trend analysis and historical correlations, it forecasts potential price movements up to several years into the future.

Key Features of Coindataflow

Coindataflow is packed with tools designed for both beginners and seasoned traders.

Portfolio Management Dashboard

Users can connect their wallets and exchanges to monitor overall portfolio performance. The dashboard provides visual analytics, profit-loss tracking, and asset diversification summaries.

Profit and ROI Calculator

This tool allows investors to simulate their potential returns based on different buying and selling prices, helping them plan more effectively.

Bitcoin and Altcoin Forecasts

One of Coindataflow’s most popular features is its forecast engine. It uses machine learning and trend-based modeling to estimate long-term prices for major cryptocurrencies. While no prediction is perfect, the accuracy rate reported by many users is surprisingly consistent.

Coindataflow User Interface (UI) and Experience (UX)

The interface is clean, fast, and beginner-friendly. Even users new to crypto data tools can easily navigate through charts, tables, and forecasting sections. The dark mode option is especially popular among night traders. Overall, Coindataflow delivers a smooth and intuitive user experience.

Coindataflow Accuracy and Reliability

Accuracy is what makes or breaks a crypto analysis platform. Coindataflow sources its data from top exchanges such as Binance, Coinbase, and Kraken, ensuring reliability.

Historical Data and Predictive Models

The system leverages five years of historical market data to enhance predictive accuracy. While long-term forecasts can vary due to volatility, the short- to mid-term predictions are often quite dependable.

Limitations of Coindataflow

No tool is flawless. Forecasts should be used as guidance rather than guaranteed outcomes. Occasional lag or misalignment between live exchange prices may occur during market surges.

Pros and Cons of Using Coindataflow

| Pros | Cons |

| Accurate data and real-time updates | Forecasts not always precise |

| Intuitive and easy-to-use interface | |

| Excellent long-term market insights | Occasional delays during high traffic |

| Strong community trust |

Coindataflow vs. Competitors

Compared to CoinMarketCap, Coindataflow offers more detailed forecasting. Against CoinGecko, it shines in long-term data analytics. TradingView remains stronger for chart customization, but Coindataflow outperforms in simplicity and prediction accuracy.

Who Should Use Coindataflow?

- Long-term investors looking for data-backed crypto predictions

- Day traders who need live updates and ROI tools

- Crypto analysts seeking advanced metrics for market research

If you fit into any of these categories, Coindataflow is definitely worth exploring.

How to Use Coindataflow for Maximum Benefit

- Create a free account on the official Coindataflow website.

- Explore market trends and add your favorite coins to a watchlist.

- Use the ROI calculator to plan potential profit scenarios.

Expert Opinions and Community Feedback

Crypto analysts frequently praise Coindataflow for its clean design and forecast transparency. Community feedback on Reddit and Twitter also highlights its reliability and user-friendly interface. Many users appreciate how the site avoids overhyping coins and focuses on real, data-backed insights.

Security and Data Privacy

Coindataflow uses HTTPS encryption and does not require sensitive data like wallet keys. All user information remains protected and compliant with international privacy laws.

Is Coindataflow Legit or a Scam?

Based on user reviews, data reliability, and transparent forecasting, Coindataflow is legit. It’s a trustworthy analytics tool, not a trading platform or investment scheme. However, users should remember that predictions are educational tools-not financial advice.

FAQs About Coindataflow Review

1. Is Coindataflow free to use?

Yes, it offers a completely free version

2. How accurate are Coindataflow predictions?

Predictions are based on historical and market data; they’re highly insightful but not guaranteed.

3. Does Coindataflow have a mobile app?

Currently, it’s web-based, but the site is fully optimized for mobile browsers.

4. Is my personal data safe on Coindataflow?

Yes. The platform follows strict data privacy and encryption standards.

5. Can beginners use Coindataflow easily?

Absolutely. The interface is user-friendly, even for crypto newcomers.

6. What makes Coindataflow different from CoinMarketCap?

It focuses more on predictive analytics and long-term forecasting rather than just market stats.

Conclusion

After an in-depth analysis, this Coindataflow Review shows that it’s a robust, data-driven, and reliable crypto analytics platform. Whether you’re a beginner or an experienced trader, its blend of real-time updates, portfolio tracking, and predictive modeling makes it a top choice for 2025.